Simplicity in Personal Finance: How to Organize Your Budget with Less Complications

Understanding the Challenges of Personal Finance

In a landscape dominated by digital banking, apps, and online payment methods, it’s paradoxical that many individuals still grapple with the basics of managing their finances. The intricacies of personal finance can lead to confusion and stress, often leaving people feeling overwhelmed. This complexity isn’t just due to a lack of knowledge; the sheer number of financial accounts and unpredictable expenses makes budget management particularly challenging.

For instance, consider someone who has multiple bank accounts, credit cards, and even student loans. With bills arriving from various sources at staggered intervals, tracking intricate expenses can turn into a full-time job. Consumers often lose sight of their financial progress when they are inundated with constant transactions, late fees, and interest rates. Moreover, many individuals face a crucial challenge: a lack of clear financial goals. Without a defined purpose—like saving for a home or retirement—it’s easy to drift financially.

Embracing a Simplified Approach

Despite these challenges, managing finances doesn’t have to be an exercise in anxiety. By adopting a simplified approach to budgeting, individuals can reclaim control over their financial destinies. Start by embracing minimalism in your spending. This means focusing solely on essential expenses, such as housing, food, and transportation, while cutting out superfluous expenditures. For instance, you might decide to cancel unused subscription services or limit dining out to once a week.

Next, consider automation as a key strategy. Setting up automatic payments for bills not only reduces the risk of late fees but also saves time and mental energy. Many banks provide an option to schedule transfers directly to savings accounts or investments, which can help in reaching financial goals more systematically.

Establishing Good Habits

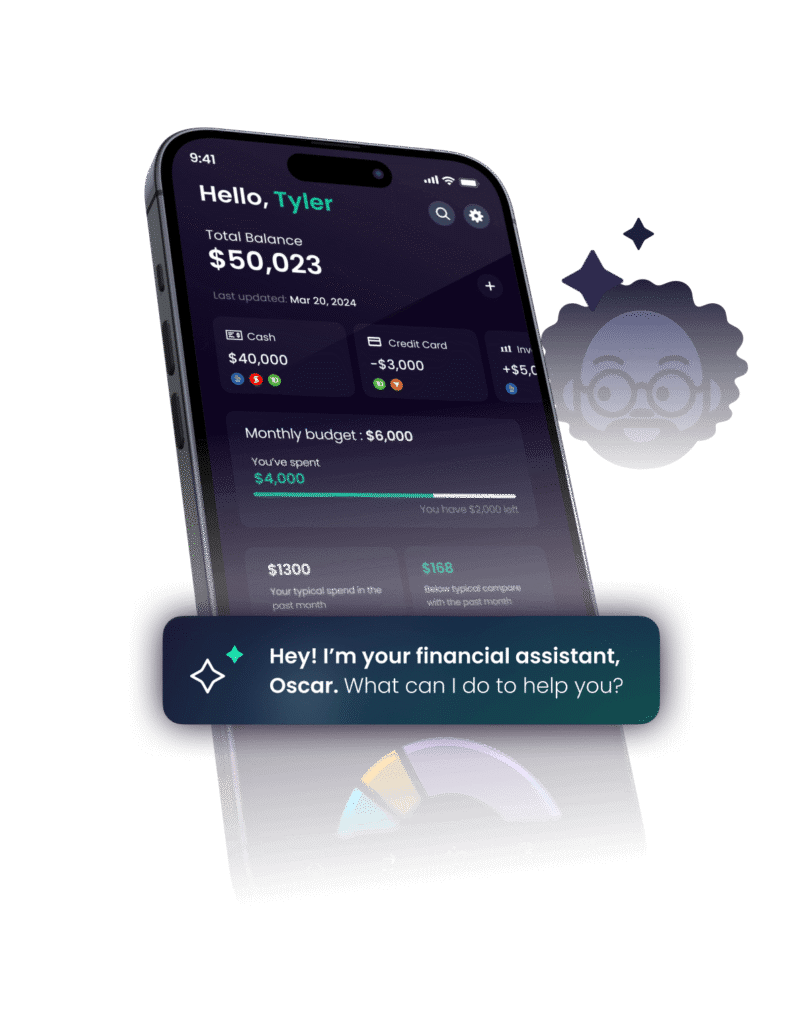

One of the most effective habits to cultivate is consistent monitoring. Regularly reviewing your budget—ideally on a monthly basis—can unveil patterns in your spending and help refine your financial strategies. Utilizing apps that aggregate all of your accounts can streamline this process, allowing you to visualize your entire financial picture in one place.

The journey towards efficient personal finance may seem daunting, but with the right strategies, it can be transformed into a manageable and rewarding process. By simplifying your approach, you’ll not only slash your financial stress but will also develop a clearer path towards achieving your financial aspirations. So, are you ready to streamline your budgeting process for a more organized financial future?

DISCOVER MORE: Click here to learn how to live intentionally

Streamlining Your Budget: Key Steps for Success

To truly embrace simplicity in personal finance, it’s essential to adopt a clear and structured budgeting method. This approach not only reduces complexity but also significantly enhances your ability to track your financial health. Below are some key steps to help you organize your budget with less complications, making every dollar work for you.

1. Define Your Income

The foundation of any budget is understanding your income. Begin by calculating your total monthly income, including all sources such as salaries, freelance work, or rental income. Accurate knowledge of your earnings allows you to establish reasonable spending limits.

2. Categorize Your Expenses

Next, identify and categorize your expenses into two main categories: fixed expenses and variable expenses.

- Fixed expenses</: These are costs that remain constant each month, such as rent or mortgage, insurance premiums, and loan payments.

- Variable expenses: These costs can fluctuate from month to month and include groceries, entertainment, and dining out.

By breaking down expenses into these categories, you’ll gain a clearer picture of where your money goes each month, making it easier to identify areas for potential savings.

3. Set Realistic Goals

A vital step in simplifying your personal finance journey is to set achievable financial goals. Whether you aim to save for a vacation, build an emergency fund, or pay down debt, having specific targets can keep you motivated and focused. Consider the SMART criteria—making your goals Specific, Measurable, Achievable, Relevant, and Time-bound—as a helpful framework. For example, instead of saying, “I want to save money,” you could set a goal of “saving $2,000 for a new car by the end of the year.”

4. Build a Simple Budgeting Method

With a clear understanding of your income and expenses, choose a budgeting method that aligns with your lifestyle. Some popular methods include:

- The 50/30/20 Rule: Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

- The Envelope System: Use cash for different spending categories, placing the allocated amounts in envelopes. Once an envelope is empty, no further spending occurs in that category for the month.

- Zero-Based Budgeting: Every dollar you earn should have a purpose, leaving you with zero unallocated funds at the end of the month.

By finding a budgeting method that resonates with you, it becomes easier to track your progress and adjust as necessary. Remember, the ultimate goal is to reinforce healthy spending habits while lightening your financial burden.

By diligently following these structured steps, you’ll pave the way for a simplified personal finance experience. And the best part? A streamlined budget can lead to peace of mind, allowing you to focus on achieving your financial aspirations. So, what will be your first step towards a more organized approach to your finances?

| Category | Advantages |

|---|---|

| Budgeting Tools | Using digital tools simplifies tracking expenses and provides an overview of financial health. |

| Automated Savings | Setting up automatic transfers fosters consistent saving habits without hassle. |

Organizing personal finances doesn’t have to be an overwhelming task. By leveraging modern technology and intuitive methodologies, individuals can substantially reduce the complications often associated with budgeting. The use of budgeting tools, for instance, can revolutionize how one perceives and interacts with their finances. These digital solutions not only make it easy to input and categorize expenses but also provide insightful analyses that highlight spending habits, ultimately guiding users toward smarter financial decisions.Another powerful advantage comes from the concept of automated savings. By creating automatic transfers to savings accounts right after paydays, individuals can effectively “pay themselves first,” ensuring that saving becomes a regular practice rather than an afterthought. This approach not only enhances discipline but also gradually builds a safety net, making the journey towards financial security far less strenuous.

DISCOVER MORE: Click here for expert tips on optimizing small spaces

Maintaining Your Budget: Consistency is Key

Once you have established your budget, the next essential step is maintaining it. Often, individuals find that the initial joy of budgeting fades away as life gets busy, leading to slippage in tracking or even abandoning the process altogether. To keep your budgeting journey on track, consider integrating the following strategies into your routine:

5. Regularly Review and Adjust

A budget is not a static document; it requires regular reviews to remain effective. Set aside time monthly to compare your actual spending against your budget. This practice will not only help you recognize patterns but also allow you to adjust your budget according to changes in income or unexpected expenses. For instance, if you notice you consistently overspend on groceries, it may indicate that your initial budget wasn’t reflective of your actual needs.

6. Leverage Technology

In today’s digital age, numerous apps and online tools can simplify your budgeting process. Options such as Mint, YNAB (You Need A Budget), and PocketGuard offer features that help you track spending, set limits, and visualize your financial goals. With these tools, you can easily monitor your transactions in real-time, categorize your expenses automatically, and even receive alerts when you’re approaching your limits. Using technology not only makes the process easier but can also be an engaging way to stay involved with your finances.

7. Build a Buffer

Financial experts often recommend building a financial buffer into your budget, especially for variable expenses. This can be achieved by allotting a small percentage of your income for unforeseen costs, such as car repairs or medical expenses. By having this buffer, you will avoid the stress of scrambling to find funds when unexpected situations arise. For example, setting aside 5-10% of your monthly budget for these contingencies can provide peace of mind and financial stability.

8. Involve Your Household

If you share finances with a partner or family, involving them in the budgeting process is crucial. Open discussions about financial priorities, goals, and spending habits can foster a sense of teamwork and accountability. By working as a unit, you’ll be more likely to stick to the designated budget and brainstorm solutions together if challenges arise. Make it a habit to have monthly family budget meetings to review expenses, celebrate successes, and adjust goals as necessary.

9. Celebrate Small Wins

Budgeting can sometimes feel restrictive or overwhelming, leading to discouragement. One way to combat this is by celebrating your small wins. Whether you successfully stick to your budget for a month or reach a savings milestone, acknowledge your achievements. This positive reinforcement can boost your motivation and commitment to maintaining a simpler financial lifestyle.

By following these strategies, you can ensure that your budgeting experience remains organized and less complicated, allowing you to focus on what truly matters in your financial journey. Keeping your budget in check may require effort, but the rewards—financial stability and peace of mind—are well worth it.

DIVE DEEPER: Click here to discover the significance of intentionality

Conclusion: Embracing Financial Simplicity

As we navigate the complexities of today’s financial landscape, adopting a philosophy of simplicity in personal finance can be a game-changer. It is clear that an organized budget serves as the foundation for achieving financial goals, whether they involve reducing debt, saving for a dream vacation, or building a retirement fund. By focusing on essential steps such as regular reviews, leveraging technology, and introducing buffers for unexpected expenses, individuals can demystify their budgeting process and foster a sense of control over their finances.

Moreover, the involvement of household members amplifies accountability and encourages collaborative efforts toward shared financial goals. Celebrating small victories, from sticking to a budget to reaching a savings milestone, can enhance motivation and help sustain long-term commitment. The key takeaway is that budgeting does not have to be a burdensome chore but can instead be a harmonious pathway to achieving financial tranquility.

The shift toward a simpler budgeting approach invites individuals to explore their spending habits and cultivate a healthier relationship with money. As you embark on your budgeting journey, remember that simplicity is not synonymous with deprivation. Embracing straightforward techniques empowers you to make informed financial choices that align with your personal values. With continual adjustments and a mindful attitude, you can transform your financial life, ensuring that it is not only organized but also truly reflective of your dreams and aspirations.